Open a new account

Account Login

The global value of commodities trading tops trillions of Australian dollars annually. With

commodities trading, you are buying and selling a broad range of financial instruments. These are

divided up into hard commodities on the one hand, and soft commodities on the other. Hard

commodities are mined or extracted from the earth or ocean floor, while soft commodities are

planted, grown, sewn, farmed, fished or produced.

But what exactly are commodities? In the simplest form, commodities are raw materials and basic

goods used in day-to-day commercial activity. Everyday folks across Australia and elsewhere buy and

sell commodities on an individual basis, or as part of a complex set of goods and services. We all

use commodities, and commodities are used as part of the production process as well.

Commodities are fungible. You can easily exchange the same commodities anywhere, at any time,

because they are freely exchangeable with one another. This is true for all commodity types

including Brent crude oil, WTI crude oil natural gas, gold, silver, platinum, wheat, sorghum, cocoa,

rice, et al. Commodity markets are efficient, liquid, and widespread. The value of commodities

trading is immense, which comes as no surprise since the global economy, like mankind, runs on

commodities.

Nowadays, commodities can be bought and sold at the click of a button. Online trading platforms like Xtrade Australia facilitate easy trading of commodities. This feature of commodities – liquidity – indicates how easy it is to trade these financial instruments. Highly liquid markets are characterised by plenty of buyers and sellers. This is precisely how we determine the most actively traded commodity markets. The Futures Industry Association (FIA) has listed the most popular commodities as follows:

Remember, soft commodities grow in the earth, oceans, lakes, and rivers. They can be sewn, farmed,

fished, or produced. There are many types of soft commodities, including all of the foods we

consume, and animal byproducts too. Examples of soft commodities include wool from sheep, leather,

venison, wheat, corn, oats, coffee, sugar, soybeans, cotton, fish, pork bellies, and the like.

By contrast, hard commodities have to be extracted from the earth, oceans, lakes, and rivers. Hard

commodities include such things as Brent crude oil, WTI crude oil, natural gas, gold, silver,

palladium, iron ore, manganese, zinc, coal, etc. Within the broad commodities market, there are

energy commodities, agricultural markets, and metals. All commodities fit into one of these broad

categories.

The world economy is built on commodities trading. These basic goods, raw materials, and precious

resources are used in our factories to generate production capacity through economies of scale, for

all the world to enjoy. The energy commodities such as natural gas, coal, ethanol, crude oil and

petroleum products power the machinery, vehicles, and equipment used in production processes. All of

these commodities are designed to stimulate global economic enterprise. The most popular commodities

include gold, soybeans, corn, natural gas, WTI crude oil, and Brent crude oil. Let's take a look at

each of these in turn:

Gold

– this precious metal has been around since the beginning of time. Traders, investors, and lay

people have long understood the value of gold, and treasured this commodity. This precious metal was

used for establishing the gold standard, and remains an important hedge against macroeconomic

uncertainty today. When stock markets are failing, traders typically shift capital resources into

gold as a hedge against volatility.

Among the many notable features of gold are its rarity, desirability, store of value, and medium of

exchange. Besides its use in jewellery, gold is also a precious keepsake in the form of gold coins

(Krugerrands), ETFs, stocks, futures, and

gold CFDs

too. The value of gold is derived from a combination of factors including its ductility, rarity,

malleability, and quasi-indestructibility.

Soybeans

– an important foodstuff, soybeans have many applications globally. They are used primarily for

feeding livestock, but also in the creation of vegetable oil for use by humans. This commodity is

one of the most heavily-traded soft commodities in the world.

Soybeans

can be found anywhere and everywhere, including grocery stores, coffee shops, restaurants, kitchens,

and homes across the island nation of Australia. The US remains the biggest soybean market in the

world with more than half of all production taking place there. Important spin-offs from soybeans

include soybean meal and soybean oil.

Corn

– known elsewhere as maize, corn was first used by the indigenous folks of Mexico some 10,000+ years

ago. Corn kernels can be eaten, and used in many different foodstuffs. In Australia, corn production

in 2021 topped 485 metric tons, at a growth rate of 31.08% almost rivalling the bumper year in 2012

at 507 metric tons, according to the US Department of Agriculture

*https://www.indexmundi.com/agriculture/?country=au&commodity=corn&graph=production

In every bushel, there are 56 pounds of corn. Technically, corn is considered a fruit, much like

tomatoes, since it comes from the ovary of the corn plant. The huge trading volume of corn comes as

no surprise, given that it is consumed everywhere on a daily basis.

*https://www.popsci.com/is-corn-fruit-vegetable-or-grain/

Natural Gas

– this non-renewable resource has widespread applications across the world. It is used in business

activity and consumer activity.

Natural gas

can be used for electricity generation, heating, and cooking. It is also widely used in the

manufacturing processes of commercial products such as plastics and organic chemicals. The world's

foremost producers of natural gas include the US, Russia, Iran, Qatar, China, and Canada. Australia

ranks in the top 10 natural gas producing nations in the world too.

*https://www.statista.com/statistics/264771/top-countries-based-on-natural-gas-production/

WTI Crude Oil

– WTI stands for West Texas Intermediate. This crude oil is extracted from the Texas basin, and is

widely respected as the best quality crude oil in the world. WTI crude oil can easily be refined

into other petroleum-related products, and is the global benchmark of excellence. WTI crude oil

trades lower than Brent crude oil on the markets.

Brent Crude Oil

– when mention is made of Brent crude oil, most people default to OPEC oil. But it also encompasses

oil extracted from the North Sea. It is a low-density crude oil with a low Sulphur content. The

biggest producers of Brent crude oil include Saudi Arabia, Iraq, Iran, and Kuwait.

You are likely familiar with plenty of commodities. The foods we eat, the products we use, and the

energy commodities used to power the global economic engine are essential to our survival. Without

commodities, the world as we know it simply would not function. From a different angle, commodities

can also be traded.

Commodities trading is a huge industry which encompasses commodity stocks, ETFs, futures, and even

derivatives like commodity CFDs. At Xtrade Australia, we focus our attention on an extensive

selection of commodity CFDs which you can trade on your PC, Mac, or mobile, courtesy of

WebTrader

. Our trading platform is fully compatible with iPhone, iPad, Android smartphones, tablets and

phablets. Now, you can trade commodities in rising or falling markets, at your leisure.

Xtrade Australia features a wide variety of commodities in a CFD format. These include:

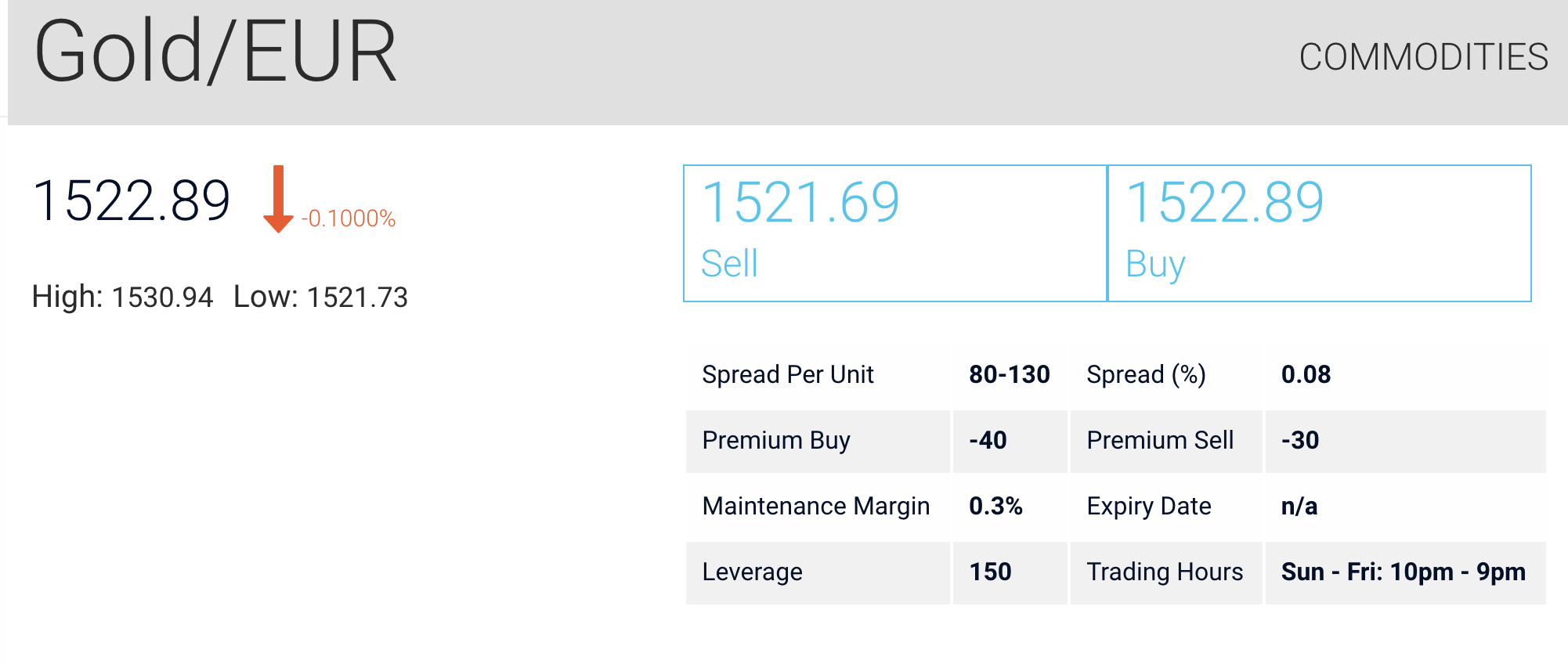

Commodity CFDs mirror the prices of the underlying financial instruments a.k.a. the commodities in question. You will notice the trading hours for commodities at Xtrade Australia are displayed from Sunday – Friday, for your benefit.

Commodities are leveraged products. As such, traders are not required to front the full value of the

trade from their own capital. You only place a small percentage of the trade amount from your

capital, known as a margin requirement. If you decide to trade gold, leverage of 1:20 is available.

This means that AU$10 can trade AU$200 worth of gold CFDs at Xtrade Australia.

Viewed differently, the margin requirement (the percentage of your capital needed to open the trade

for a gold CFD) is just 1/20, or 5%. While low margin requirements and high leverage appear to be

big benefits, they are not without risks. As a commodity CFD trader, you can significantly magnify

your profits or your losses when leverage is used.

Remember

: The higher the leverage and the lower the margin requirements, the riskier the potential outcomes.

You will be liable for the full value of the trade if it moves against you, not simply the margin

requirement to open the trade.

Risk Disclaimer

CFD trading is inherently risky, and not suitable for all types of traders

Caveat

: It is important to understand that traders are liable for the full value of the trade, not simply

the margin requirement.

Once you're ready to trade commodity CFDs, you need to decide whether the commodity is likely to

rise or fall in value. Traders can speculate either way with commodity CFDs. If your expectations

are bullish, you will BUY the commodity CFD. If your expectations are bearish, you SELL the

commodity CFD. Buying a CFD is the same as going LONG, while selling a CFD is the same as going

SHORT.

Traders use a combination of technical analysis and fundamental analysis to speculate on commodities

pricing. The technical side involves charts and graphs, patterns, support and resistance levels,

SMAs, EMAs, and trend lines. Fundamental analysis involves the macroeconomic indicators, economic

calendars, financial reports, et cetera.

The opening price of the contract, and the closing price of the contract are used to determine the

size of your profit or loss. It is quite possible to generate substantial profits, or incur sharp

losses

with commodity CFDs trading. Xtrade Australia offers no commissions and fixed spreads for

cost-effective commodity CFDs trading.

With commodity CFDs trading, you don't physically take possession of the commodities being traded.

You're simply trading contracts for difference (CFDs) which mirror the price movements of the

underlying instrument. CFDs are short-term contracts. The price of a CFD can be identical to that of

the underlying asset. Certain CFDs linked to a spot price or a futures contract may have an expiry

date. CFDs held past 10 PM GMT are subject to fees.

If the Reserve Bank of Australia decides to raise interest rates, this will affect gold prices.

Rising interest rates make the AUD more attractive, and this makes gold more expensive to foreign

buyers. Ultimately, rising interest rates drive down the price of gold. Since gold doesn't pay

interest, investors will put their money elsewhere where they can earn better interest. Believe it

or not, the gold price can rise when interest rates are rising as it did in the 1980s, but it can

also fall when interest rates are falling as it did in the 2000s.

Leverage and margin are a double-edged sword. When used correctly, and judiciously, commodity CFD traders can benefit from them. However, losses can also be magnified using commodity CFDs. It's always a good idea to have a solid grounding in the intricacies of CFD trading, and the economic factors influencing demand and supply. Put your knowledge to the test on our demo trading platforms, and fine-tune your trading skills in the process.

It takes less than 2 minutes to open an account with Xtrade. Use Credit Card or Bank Transfer to fund your account.

List of CommoditiesGet started with your Xtrade account today

This website uses cookies to optimize your online experience. By continuing to access our website, you agree with our Privacy Policy and Cookies Policy . For more info about cookies, please click here.

or